Contents:

Avoid projects with little or no social media presence and vague roadmaps. Use a secure wallet to store digital assets like cryptos and NFTs. NFTs are important Web3 investments because they can be used to unlock special privileges or as an investment in a Web3 company.

GameStop Stock: What to Expect in 2023 – Meme Stock Maven – TheStreet

GameStop Stock: What to Expect in 2023 – Meme Stock Maven.

Posted: Wed, 28 Dec 2022 08:00:00 GMT [source]

You cannot invest directly in Web 3.0, but you can choose to be an active or passive investor through a variety of investment options. Active investment options include cryptocurrency and NFTs, while passive investment options involve buying stocks in companies actively engaged in Web 3.0. The foundation of Web3 is built on emerging technologies such as blockchain tech, smart contracts, and AI. An investment into Web3 positions gives you the chance to be an early adopter of these disruptive technologies. The most common Web3 investment options are stocks, cryptos, and NFTs.

Best Web 3.0 Stocks to Buy: Block (SQ)

“Last year we saw a big Ponzi scheme — ‘pump and dump’ — but it had nothing to do with technology,” she said. “Hopefully, we’ll get all the fraudsters and the corrupt actors to go away.” But this won’t happen until regulators establish clear new regulations that they can enforce, she added. Of course, this has massive implications for Web3 stocks. Web3 stocks proved highly profitable in 2021 with total venture capital investments of more than $32.4 billion. And in the first half of 2022 alone, investments surpassed $18 billion. With web3 now being used in various sectors such as social media, energy, gaming, art, and real estate, it’s no surprise these stocks have continuously gained in popularity.

Now may be a great entry point for shares for those bullish on its long-term prospects. Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. Faizan has several years of experience in analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio. If you are interested in stocks, it is a good time to buy a company that deals with Web 3.0, because it is one of the best companies out there on the market at this point. Cryptocurrencies have been around for a while and they’re becoming more popular by the day.

She especially enjoys setting up weekly covered calls for income generation. IBM is a technology company that operates as a global integrated solutions and services provider. The company functions through the four broad business segments of Software; Consulting, Infrastructure; and Financing.

Could Cathie Wood’s ARK Innovation ETF Add GameStop Stock to … – TheStreet

Could Cathie Wood’s ARK Innovation ETF Add GameStop Stock to ….

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

In other words, web3 is an internet that we can all responsibly “goof off” on without any bureaucratic joy-killers getting in the way. Whether you’re looking for short-term trades or long-term investments, we’ve come up with high-potential web3 stocks for you to watch. Our next Web 3.0 stock is the microblogging platform Twitter. Analysts point out how important it will be to reach an audience in the upcoming decentralized world. Since Twitter facilitates the organic development of niche communities, it already enjoys a key competitive advantage among social media names. It plays a vital role as a centralized exchange that investors can trust with their cash, cryptocurrency and NFTs.

Web 3.0 Stocks to Buy

With a market capitalization of around $29 billion, against projections of around $1.5 billion in sales this year, it may have more room to fall before it’s truly bottomed out. Then again, despite its still-high valuation, waiting for an even lower price before buying may result in you missing the chance before it takes off again. I stand behind my view that PLTR stock could keep on facing challenges in the short term. Yet, with its drop to around $10.40 per share, further downside may be moderate.

- However, tech giants have strongly rejected the breakup proposal.

- The business sees these acquisitions as a chance to consolidate its position at the apex of the Canadian market, as well as a key part of its preparation to take its business global.

- Operating income increased 24.3% from the prior-year quarter to $22.25 billion.

- Some people believe that a new paradigm for the internet is coming, called Web 3.0—also often styled Web3.

- Bitcoin, the beacon of crypto asset class, has been at the forefront of this change over the years.

With the world gripped with omicron variant fear, those who prefer to zig while others zag could key in on early reports that suggest omicron-related infections produce mild symptoms. With the prospects of web3 at its fingertips, Meta looks ready to dominate the metaverse and is already one of the most profitable companies in the web3 sphere. Remember those post-dot-com crash opportunists that popped up and took over the internet? Mark Zuckerberg knows a thing or two about the future of web3, which is why he confidently flipped the switch on Facebook’s rebrand to Meta Platforms. Bitcoin arm is getting ready to revolutionize the internet with its launch of web5. Its new vision promises to give users complete control over their own data, unlike the current approach of handing it off to third parties.

Web 3.0 Stocks With Millionaire-Maker Potential

All this talk feels like we’re at the cusp of a new internet being created. If that’s true, then this would be the perfect time to start hunting for web 3.0 stocks to buy. Coinbase operates the largest crypto trading platform in the U.S. It also offers crypto wallet products and has an investment in several startups with Web 3.0 projects. Considering that crypto tokens will be central to many Web 3.0 applications, Coinbase should see increased trading activity on its platform as Web 3.0 adoption expands.

However, its near-https://1investing.in/ valuation relies mostly on the mainstream adoption of crypto. Web 3.0 promises to offer user-specific, peer-to-peer internet services with no single authority. It aims to be a more decentralized and transparent version of today’s internet where people gain control over their data. Of course, this transformation has enormous implications for Web3 stocks. The 1990s and the early 2000s gave the world an unprecedented change through the rise of what we call the Internet.

Therefore, it truly behooves you to consider Web3 stocks to buy. The concept of Web3 is not to make our current internet obsolete; it’s to integrate these technologies into the existing infrastructure, allowing everyone to freely use the internet. For example, if you make a Facebook or Instagram post that goes against Meta’s community standards, the social media giant could take the post down or ban your account. This would likely be impossible in Web 3.0 since most platforms will be decentralized. It is a decentralized version of the internet that promises to help users better control their data usage and sharing while enhancing monetization and reducing exposure to data manipulation. Developers can and have made a huge variety of technology using blockchain technology, including things like social networks, video games and search engines.

View All People & Culture

More people are entering the market, buying coins and some are getting more sophisticated in their purchases. One of the most popular crypto exchanges in the industry is Coinbase Global. New developments in decentralized Web 3.0 technology should mean higher growth for the ecosystem as a whole. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global 500 companies. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. If we’re going to talk about the future of the internet, it’d be remiss not to mention the future of transportation.

Web3 and NFTs Explained – Nasdaq

Web3 and NFTs Explained.

Posted: Mon, 29 Aug 2022 16:10:07 GMT [source]

Cynically, an argument exists that Nvidia’s deep learning initiatives will eventually serve a deleterious effect to society due to the replacement of human workers with machines. However, there’s also a massively positive implication as it relates to Web3 stocks. Eventually, Nvidia’s tech could replace centralized third-party intermediaries , thus truly making the internet free. If we’re going to talk about Web3 stocks, no discussion is truly complete without mentioning Nvidia. Perhaps best known for its gaming-related graphics processing units , NVDA stock has been one of the clear beneficiaries of the crypto complex’s rise.

However, if this trend plays out like those who are bullish on it expect it to play out it may be something that helps this hard-hit SaaS play get out of its recent slump. Conversely, that does mean possibly limited upside from it as well. Nevertheless, if you are still skeptical about this trend, yet want some exposure to it, owning Microsoft shares may be the best way to do it. Right now, it’s still unclear whether the “crypto winter” will end when the Northern Hemisphere winter ends in March.

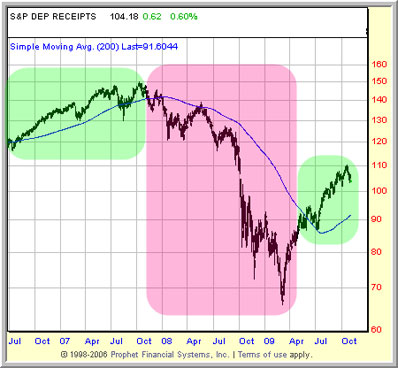

Very volatile during October, where it dipped, then rose sharply, due to rumors it was a short-squeeze candidate, since then this stock has experienced a tremendous drop in price. Unity is a software company that develops tools for game developers to create 3D and 2D games. Nvidia’s new chips will allow developers to create web 3.0 applications and platforms, while Nvidia Omniverse provides the platform they need to make their awesome projects.

Simply put, this stock is worth considering for any investor looking to grow their portfolio. Unity Software Inc.’s price has skyrocketed in the last couple of years, bucking the trend of market instability—and it’s just getting started. With a stock price high of $145 in 2022 and a low of only $21, this is one stock that investors are sure to want to get in on. The fintech group announced Q results in early November.

Sliding again, after partially rebounding from its post-merger the effect of public offering on stock price sell-off, now may be a great time to dive into it. Its exposure to this trend may not be something that drives a full recovery for TTWO stock. Yet with the rate-hike-fueled tech sell-off and growing concerns about its slowing revenue growth, the NET stock has since given back almost all of its gains. If it fails to ride the Web 3.0 trend to significantly higher sales, it’ll likely burn through its $25.8 million cash position, necessitating the need for future capital raises. Unfortunately, for investors who bought in when it peaked in price, its “hotness” proved to be fleeting.

Semiconductor Stocks For Your Late-April 2023 Watchlist

Net loss came in at $12 million, or 5 cents loss per share. Net income increased 62% to $2.97 billion, or $1.17 per diluted share. Several companies are working on web3 solutions and products. While a lot of this may well be in its experimental stage, clearly, the company is dedicated to moving along with the times and helping to remain a highly innovative company in the future. This is all because, indeed, Apple has been involved with some of the most exciting technological innovations of recent decades.

It’s about the direct connection between creators and consumers, obfuscating the gatekeepers.” Naturally, Web 3.0 stocks are catching the eyes of investors as a result. Web 3.0 is a loose concept at the moment but is expected to be the future of the world wide web. Here are three fundamentally solid stocks that are well-positioned to capitalize on the new internet era.

A few examples include Ethereum , Solana and Avalanche , to name a few. But as crypto winter set in in 2020, the NFT market crashed. Professional investors and art world critics derided NFTs as little more than a speculative bubble. Advocates see a wide variety of potential use cases for NFTs, but to date the only widespread use has been for digital artworks.

Apple has not responded in the same way, but it will unlikely be unable to do so for much longer. Apple Pay integrating web3 is a highly anticipated move from the company. Coinbase’s venture capital, Coinbase Ventures, has directly supported the development of blockchain companies such as Solana or BlockFi, among others.

Impressively, MSFT stock has risen more than 30% over the past year. As the stock market continues to show a lack of direction, investors are taking the opportunity to explore newer themes in the stock market. Consequently, Web 3.0 stocks are emerging as a popular choice among investors.

Wall Street regards Nvidia as the undisputed leader in advanced semiconductor design and software for next-generation computing development. The chipmaker is well-known for its chips used in gaming and data centers. Net income soared to $406 million, or $1.62 per diluted share, up from $81.3 million in the prior-year quarter. The transaction adds significant AI capabilities to AMD’s offerings. Analysts expect it to gain a strategic foothold in Web 3.0 markets, such as networking infrastructure and automotive technology.